Navigating the 2025 Hairstylist Tax Deduction Maze: A Comprehensive Guide

Related Articles: Navigating the 2025 Hairstylist Tax Deduction Maze: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Hairstylist Tax Deduction Maze: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Hairstylist Tax Deduction Maze: A Comprehensive Guide

The life of a hairstylist is a vibrant blend of creativity, client interaction, and meticulous attention to detail. However, behind the stylish exterior lies the often-complex world of self-employment taxes. Understanding your tax obligations as a hairstylist is crucial for maximizing your earnings and avoiding potential penalties. This comprehensive guide delves into the potential tax deductions available to hairstylists in 2025, offering insights to help you navigate the complexities of filing your taxes accurately and efficiently. While specific tax laws are subject to change, this guide provides a framework based on current understanding and projections for 2025. Always consult with a qualified tax professional for personalized advice.

I. Understanding Self-Employment Taxes:

Unlike employees who have taxes withheld directly from their paychecks, hairstylists (and other self-employed individuals) are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. This is often referred to as self-employment tax. In 2025, the self-employment tax rate is projected to remain around 15.3% (though this is subject to change based on legislation), with half (7.65%) deductible on your income tax return. This is a significant expense, but understanding the available deductions can significantly reduce your tax burden.

II. Key Deductions for Hairstylists in 2025 (Projected):

The key to minimizing your tax liability lies in meticulously tracking and documenting your business expenses. The following deductions are particularly relevant for hairstylists:

A. Home Office Deduction:

Many hairstylists operate from a dedicated space in their home, whether it’s a converted bedroom, a basement studio, or a section of their garage. If you meet the IRS criteria for a home office (used exclusively and regularly for business), you can deduct a portion of your home-related expenses, including:

- Mortgage interest: A percentage of your mortgage interest, based on the square footage of your home office compared to the total square footage of your home.

- Property taxes: A percentage of your property taxes, calculated similarly to mortgage interest.

- Homeowners insurance: A percentage of your homeowners insurance, based on the same square footage calculation.

- Utilities: A percentage of your utilities (electricity, heat, water, etc.), again proportional to the home office space.

- Repairs and maintenance: Expenses for maintaining the home office area.

Important Note: The IRS has specific requirements for claiming the home office deduction. It’s essential to maintain detailed records and ensure your home office meets the definition of a "principal place of business" or a "place of business used exclusively and regularly for administrative or management activities."

B. Business Expenses:

Numerous expenses directly related to your hairstyling business are deductible. Keep meticulous records, including receipts and invoices, for each expense:

- Professional Supplies: This includes hair products (shampoos, conditioners, styling gels, etc.), dyes, foils, hair extensions, tools (scissors, combs, brushes, curling irons, flat irons), and other consumables used in your services.

- Equipment: The cost of durable equipment, such as styling chairs, shampoo bowls, hair dryers, and other professional tools, can be depreciated over their useful life. This means you deduct a portion of the cost each year.

- Marketing and Advertising: Expenses related to promoting your business, including website development and maintenance, social media advertising, business cards, flyers, and local directory listings.

- Education and Training: Continuing education courses to update your skills and stay abreast of the latest trends are deductible. This includes classes, workshops, and seminars.

- Insurance: Professional liability insurance (also known as malpractice insurance) is crucial for protecting your business from potential lawsuits. The premiums are deductible.

- Travel Expenses: If you travel for business purposes (e.g., attending hair shows, industry events), you can deduct travel expenses such as transportation, accommodation, and meals (subject to limitations).

- Rent and Utilities (if not home-based): If you rent a salon space or studio, the rent and utilities are deductible business expenses.

- Salaries and Wages (if applicable): If you employ assistants or other staff, their salaries and wages are deductible.

- Vehicle Expenses: If you use your vehicle for business purposes, you can deduct either the actual expenses (gas, oil, repairs, insurance) or a standard mileage rate (set annually by the IRS). Keep a detailed log of your business mileage.

- Accounting and Legal Fees: The cost of professional services, such as accounting and legal advice related to your business, are deductible.

- Software and Subscriptions: Costs associated with software used for scheduling appointments, managing clients, or other business functions are deductible.

C. Self-Employment Tax Deduction:

As mentioned earlier, you can deduct one-half of your self-employment tax liability from your gross income. This significantly reduces your overall tax burden.

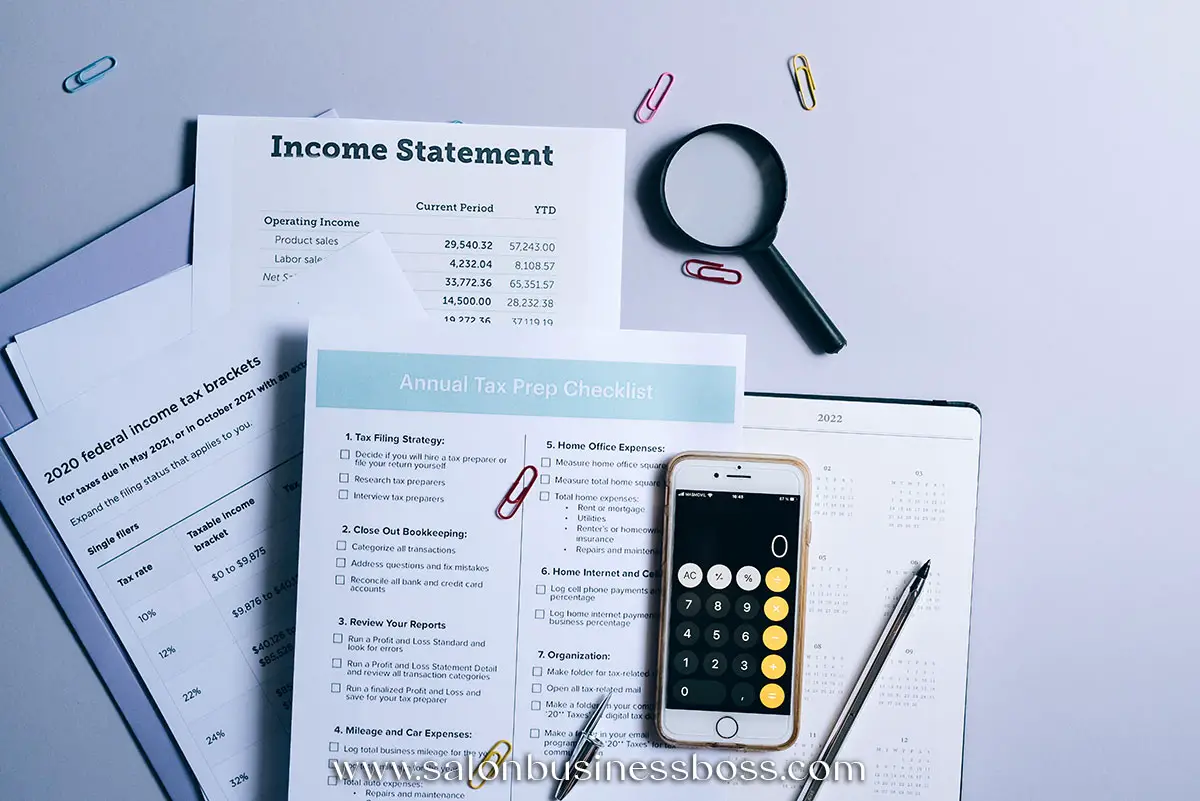

III. Record Keeping: The Cornerstone of Successful Tax Filing:

Accurate and thorough record-keeping is paramount. The IRS requires you to maintain detailed records of all income and expenses for at least three years. Consider these strategies:

- Digital Accounting Software: Utilize accounting software designed for small businesses to track income and expenses, generate reports, and simplify tax preparation.

- Receipt Organization: Keep all receipts organized in a system that allows for easy retrieval. Consider using a dedicated filing system, either physical or digital.

- Mileage Log: If you use your vehicle for business, maintain a meticulous mileage log, recording the date, purpose of the trip, starting and ending mileage, and total business miles.

- Client Records: Keep accurate records of all client transactions, including services rendered, payments received, and outstanding balances.

IV. Tax Forms Relevant to Hairstylists:

Several tax forms are relevant to hairstylists:

- Schedule C (Form 1040): Used to report profit or loss from your hairstyling business.

- Schedule SE (Form 1040): Used to calculate your self-employment tax.

- Form 1099-NEC: Received from clients who pay you $600 or more during the year.

V. Seeking Professional Tax Advice:

While this guide provides a general overview, the tax laws are complex and subject to change. It’s strongly recommended to consult with a qualified tax professional or accountant who specializes in working with self-employed individuals. They can help you:

- Optimize your deductions: Ensure you’re claiming all eligible deductions and maximizing your tax savings.

- Understand the latest tax laws: Stay updated on any changes that may impact your tax obligations.

- Prepare and file your tax return accurately: Avoid potential penalties and audits by ensuring your return is accurate and complete.

- Plan for future tax liabilities: Develop a long-term tax strategy to minimize your tax burden in the years to come.

VI. Conclusion:

Successfully navigating the world of hairstylist tax deductions in 2025 requires careful planning, meticulous record-keeping, and a thorough understanding of relevant tax laws. By diligently tracking your expenses, utilizing available deductions, and seeking professional advice when needed, you can significantly reduce your tax liability and ensure the financial health of your thriving hairstyling business. Remember, proactive tax planning is an investment in the long-term success of your career. This information is for guidance only and does not constitute tax advice. Consult a qualified professional for personalized assistance.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Hairstylist Tax Deduction Maze: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!